Championing

Women At Work

Before there were coaches, communities, and blogs on career advice, Nicole Williams was consulting with some of the world’s most influential companies on how to attract and retain female talent.

Today WORKS by Nicole Williams is a leading brand of its own — a career management agency helping women go further faster than they could on their own. Utilizing an agile approach to careers, Nicole coaches and connects professional women who want to increase their profile and reach their full intellectual, creative, and earning potential.

TRANSFORMING LIVES THROUGH WORK

Nicole offers an alternative to the

dated and general career advice — one

that delivers on the oft unfulfilled promise

of women supporting women.

It’s Not Your Career, It’s Your Life

In this post-pandemic world the lines between the personal and the professional have become increasingly blurred, making the playing field more challenging for both employers and employees.

Nicole’s innovative approach supports companies and employees to embrace new, flexible work models and cultivate a workforce that is encouraged to design their own careers.

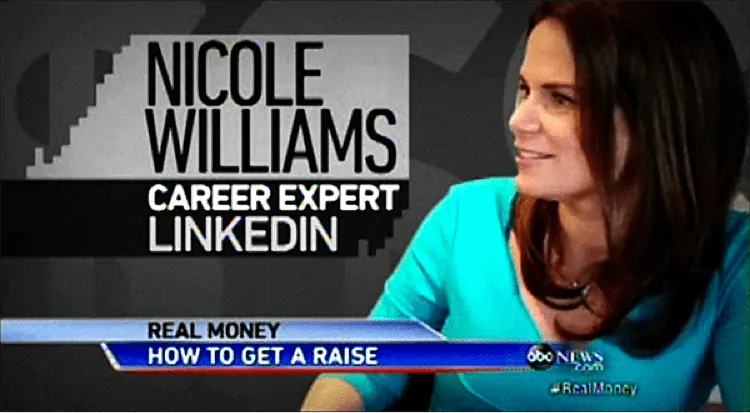

MEDIA CONTRIBUTOR

-

5 Ways Mentoring Can

Help Your Career -

How Job Seekers Can Say ‘Look At Me’ To Online Recruiters

-

Your Childhood Dream Job Has A Lot To Do With Your Current Success

-

Tips For Finding, Reigniting, and Building Inspiration

-

Book Release: Girl on Top

-

Do You Deserve More? 7 Tips For Negotiating A Raise

-

In Pictures: Best 10 Career Sites For Women

-

The Art Of Online Portraiture

-

Simple Ways To Appear Successful, Smart In Life And Work

-

Top Job Tips And Tricks

“Nicole Williams takes a

lighthearted approach to showing

us how to find (refind?) and keep the

professions of our dreams.”

Elle

THE JOURNEY

-

1997

Director of Career and

Technology, CNIBFulfilling a need for visually-impaired

Canadians, Nicole created an accessible

career development program, which

would later go on to be audited by the

federal government and offered across

the country. -

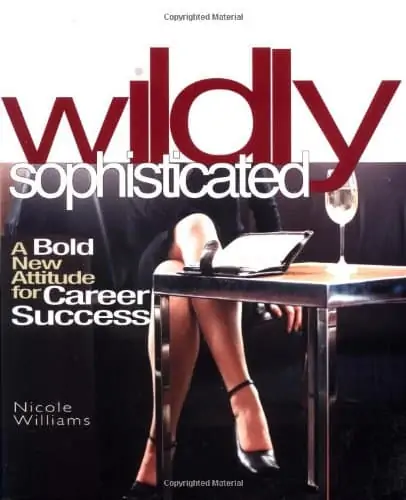

2004

Published first

bestselling bookWith a record-breaking book deal,

Wildly Sophisticated was released

as the modern day working guide

for women, kicking off three

bestselling books authored by

Nicole in under five years. -

2006

Launched WORKS by

Nicole WilliamsAfter moving to NYC, Nicole received

a multi-million dollar investment,

allowing WORKS to expand from

coaching and workshops to a

provocative and trusted multi-channel

platform for women at work. -

2009

Multi-city tour

in partnership

with The LimitedUsing the Girl On Top book launch as

an opportunity to attract hundreds of

influential women across the country,

Nicole stewarded a 15-city, 17-event

tour that exposed new customers to

The Limited brand and established

their clothing line as the go-to for

professional attire. -

2011

Named LinkedIn’s

Official Career ExpertNicole was recruited to represent LinkedIn

in consumer-facing media and head up

internal and branded career content,

solidifying LinkedIn’s position as the

leading resource for all matters career. -

2020

Founded ELLA

WORKS FoundationRecognizing the gender and

structural dynamics that influence a

woman’s potential, Nicole launched

the ELLA WORKS Foundation, giving

back to a community of women

who have been overlooked and

underserved in their personal

development and career preparation.

PAST CLIENTS

Current Projects

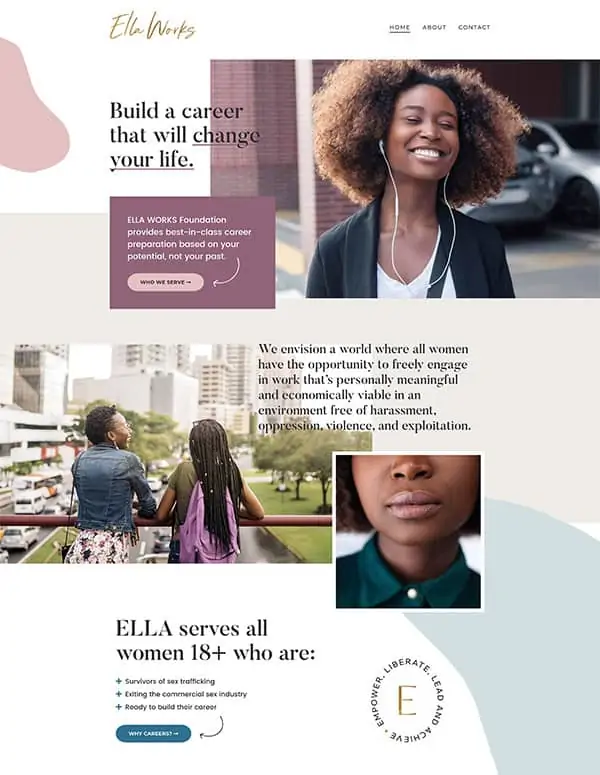

ELLA WORKS Foundation

Founded in 2020, ELLA WORKS is a career development and mentorship program assisting trafficking survivors and women transitioning from the commercial sex industry.

WORKS 2.0

Your network is your net worth. So why is traditional networking so painful? Part playbook, part secret society, this platform will help you to thrive in your career and life.

Get In Touch

Speaking + Partnerships + Consulting